“A goal without a plan is just a wish.”

– Antoine De Saint-Exupéry

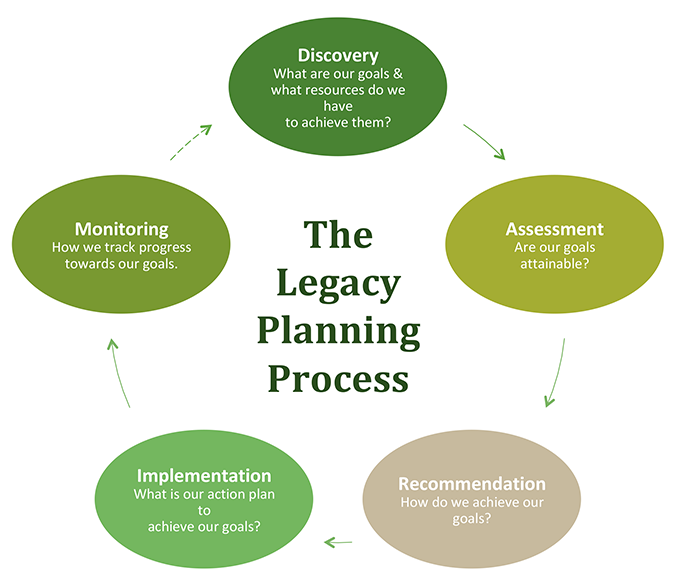

Our goal is to assist you with as many areas of your financial circumstances as you desire or need. To systematically accomplish this objective, we utilize The Legacy Planning Process.

Discovery

We meet with clients to understand their goals and current situation. We gather data in this phase to construct an overall picture of their estate so that we can advise them holistically.

Assessment

We compile and analyze the data to create various reports and projections.

Recommendation & Implementation

We meet with clients to review our findings and recommendations. We collaborate with our client’s other advisors (CPA’s, estate planning attorneys, real estate brokers, insurance agents, TPA’s, etc.) to ensure information is communicated to the appropriate parties and plans are executed in an efficient and cohesive manner

Monitoring

We check in with clients throughout the year and update & review our analysis as needed.

Some Areas Covered:

- Cash flow analysis

- Retirement planning including benefits analysis and distribution planning

- Educational funding

- Optimizing income tax strategies (working closely with our clients’ CPA’s)

- Planning for major life events – buying and/or selling a home, marriage, divorce, employment and business opportunities, health issues, or inheritance

- Risk management

- Estate Tax planning (working closely with our clients’ Estate Planning attorneys)

- Charitable giving (working closely with our clients’ attorneys, CPA’s and community foundations)